There are many payment models in the affiliate world. But in the sphere of financial offers, the most common models are:

– Cost Per Sale (CPS)

– Cost Per Lead (CPL) and (CPQL)

Table of contents

Cost Per Sale (CPS), or payment per sale

This means you will receive a payment after the customer you refer gets a loan. This system is beneficial to everyone:

– the highest rates compared to other models for the affiliate,

– the advertiser only needs to calculate what part of the profit he will spend on marketing.

However, there are disadvantages. Compared with other models, the conversion from a visitor to a borrower may be low, especially if the advertiser has too high requirements for the borrower. These requirements are always specified in the description of the offer.

Cost Per Lead (CPL), or payment per lead

Assumes remuneration to the site owner for attracting a potential client who left his contact information on the advertiser’s site.

This model is attractive by generating plenty of leads, but the price is much lower than in CPS.

BUT. There is a very significant disadvantage:

The advertiser can refuse to pay in part or in full if he considers the quality of traffic unsatisfactory.

Comparing models

A common opinion prevails in the market of financial offers: CPL is better than CPS. For example, a couple of years ago, MoneyCat gave $8 on CPL vs. $13 on CPS for the Philippines.

The average percentage of lead confirmation in LeadBit Finance is 21% (at the moment of publication)

Simple calculation:

8$ / 21% = 38$ and this is significantly higher than the CPS rate = 13$

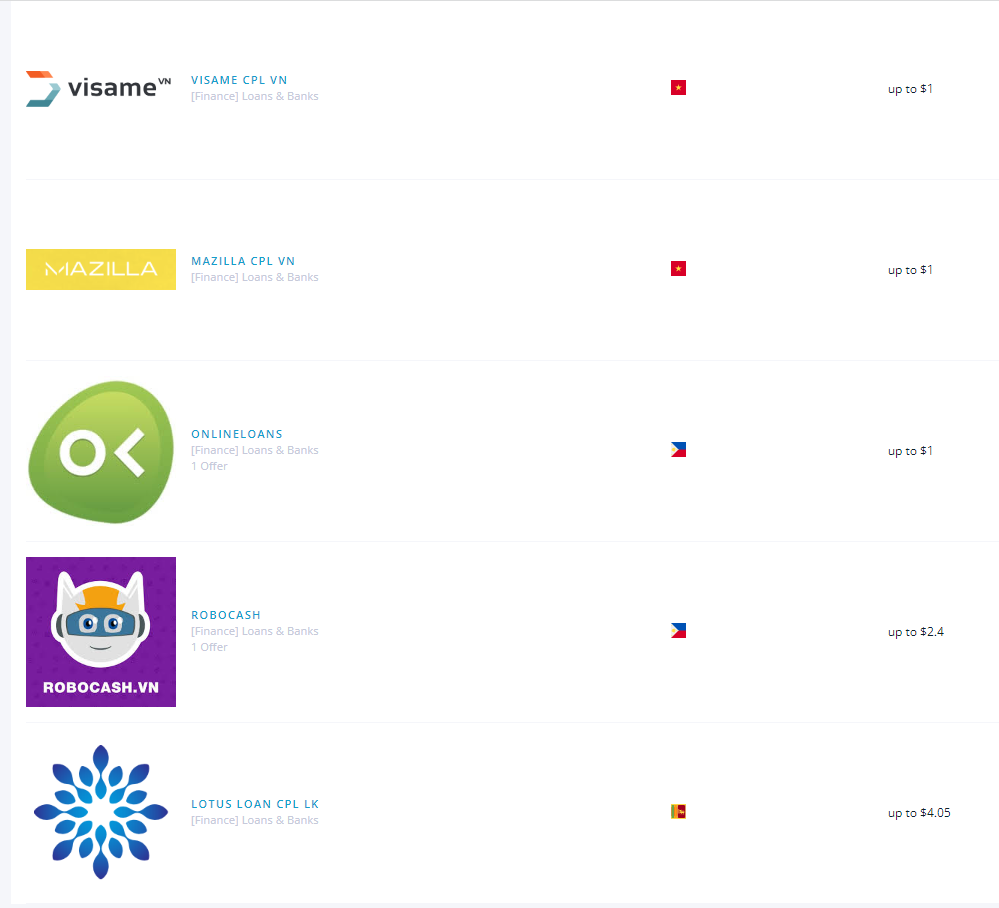

But the MFO market has matured: the same MoneyCat long ago reduced CPL rates to 2$ and later abandoned this payment model altogether. CPL offers in Asia with a rate higher than 2$ can literally be counted on one hand:

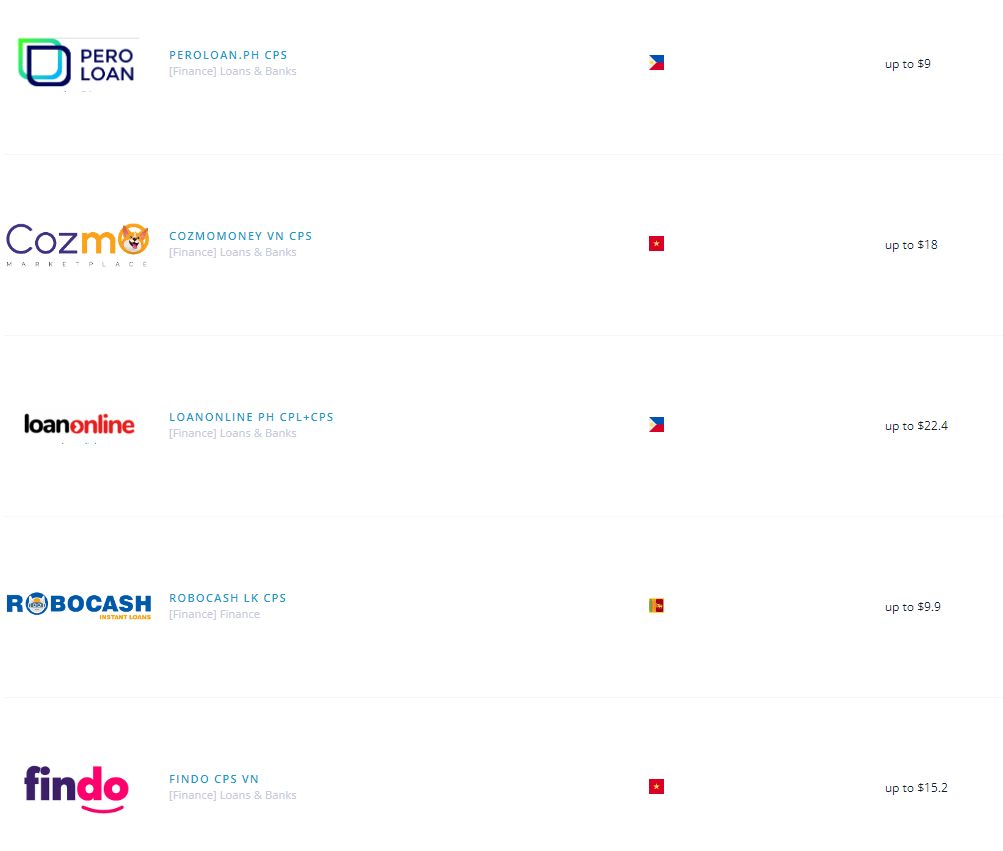

In contrast, prime rates for CPS have increased:

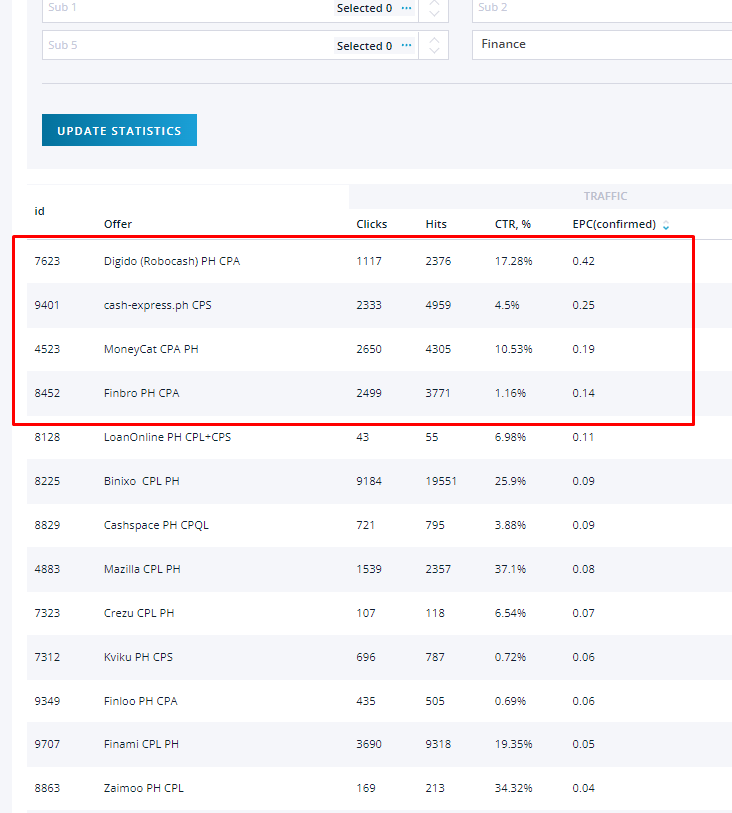

Proof of the conclusions above – statistics from one of our partners working with the Philippines:

Sorting by the EPC column, it’s easy to see that the 4 most profitable offers he has are CPS, namely Digido, Cash Express, MoneyCat, Finbro.

Let’s sum it up

Today, the CPS model is many times more profitable than CPL:

– Advertisers can readily raise your bid if the quality of your traffic is good

– There is no risk that you will not be paid, considering your traffic is low quality. After all, the quality of traffic is the conversion rate of a lead in the search engine’s output. You will be able to plan your budget without fear!

Sincerely Yours,

Leadbit Finance Team!