Novice affiliate marketers in the LeadBit network often turn their gaze, first of all, to financial affiliate programs. Everything here seems pretty cut and dry. Financial services are always in demand: during a crisis and at the peak of economic stability. The vertical is legal, with a minimum of restrictions among social networks and search engines. Banks and small financial institutions pay well for new clients.

But is everything so colorful: you post creatives and tomorrow a dump truck full of money drives up to your house?

Affiliate marketing, as many of our partners will confirm, is a nervous occupation, forcing you to remain completely absorbed in the process 24/7. I would say financial affiliate programs are among the most stressful. The competition is insane, at certain moments the bid per click from ad networks simply goes off the charts. It won’t be that easy to become a partner or a large bank or brokerage company, even through an affiliate network. You need to meet certain criteria.

It is most convenient to start with microfinance organizations, most of which are outright scams (there are no such ones in the LeadBit network, our analysts carefully check each advertiser). As a result, another problem is revealed – the issue of trust. It doesn’t matter if you send traffic to a forex broker, a microfinance organization or a bank, even thousands of referrals will not give you a profit if the company is very shady.

This all may give you the impression that I am discouraging you from working with financial affiliate programs. No, I definitely am not! In terms of profitability in the LeadBit partner network, this vertical is one of the best, constantly competing for the first place with gambling and adult dating. In some aspects it’s even easier here: there’s no need to fiddle around with cloaking, or get banned from Facebook or Google. But to make a profit, you need a lot of investment. Since I genuinely want our network to have as many successful members as possible, I feel it is my duty to not sugarcoat it and describe the potential obstacles as they are.

We have collected the best sources of adult traffic in this article .

This area has its own “laws”, methods that work elsewhere won’t necessarily cut it here. How to get around the pitfalls? How to find a safe fairway and drive traffic without going into the red? Where can you find the most profitable traffic sources? This is what we’re planning to talk about today.

Table of contents

Financial affiliate programs – prospects of the vertical

No, we will not talk about how the financial market is developing. For us, the main question is: how and how much money can we make off it?

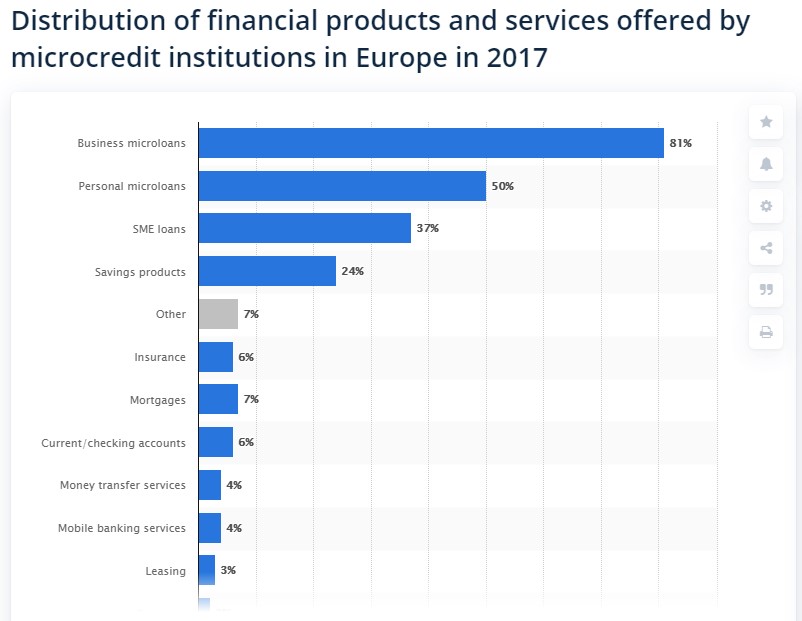

To begin with, let’s clear up what exactly qualifies as a financial affiliate program. There are several areas here:

- More often. Affiliate marketers cooperate with microfinance organizations (MFO – microloans within five minutes for up to a month) or sometimes with small banks. Large banks (sometimes referred to as too-big-to-fail lenders) mainly work directly with advertising sites;

- Business loans. Unlike loans for individuals, the terms of cooperation and the size of payments are different here. Other promotion technologies are used;

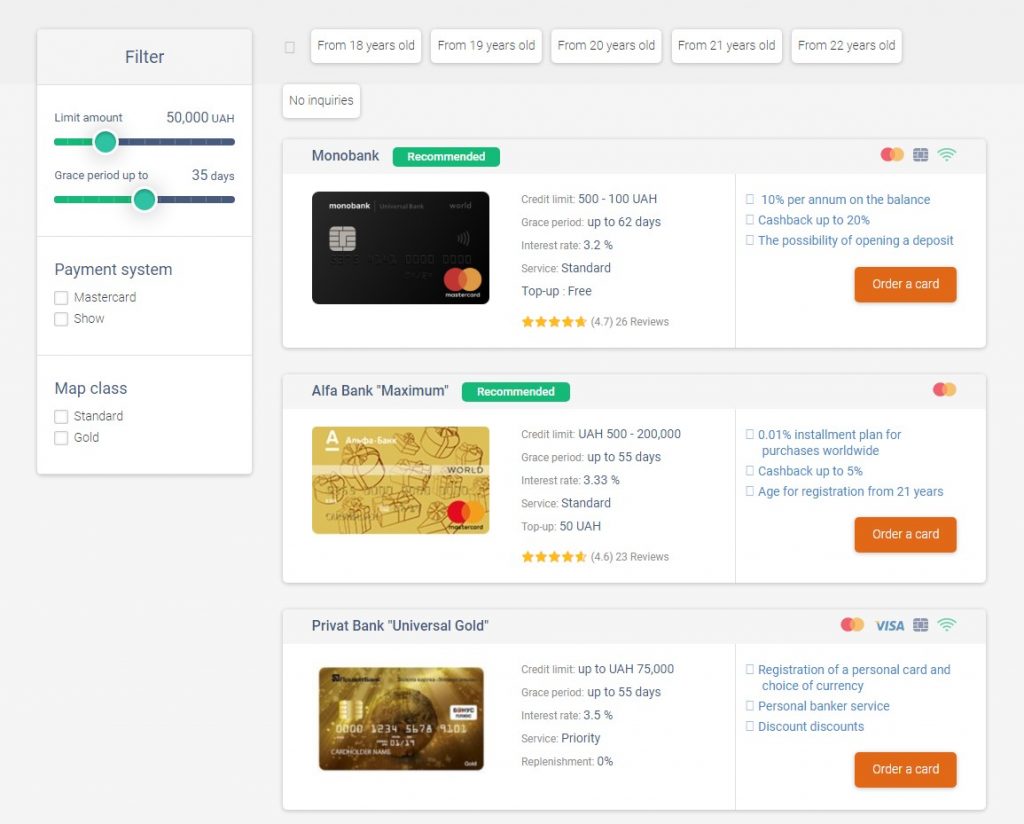

- Websites for comparing banking products and services. Websites where you can compare the terms of several banks or credit cards, quickly find a loan, mortgage or insurance;

- Forex or cryptocurrency trading (some affiliate marketers consider these part of the gambling vertical (about gambling offers you can read here). This niche is the most attractive for affiliate marketers. It offers the largest payments for a lead and you can work according to the Revenue sharing model (revshare – the company constantly deducts a part of the profit made off the attracted user in favor of the partner);

- Companies that offer a passive income. Most often they offer to invest in insurance companies, startups, cloud mining, loan issuance services, bitcoin, etc.

Read the LeadBit review “How to drive traffic to crypto programs and binary options.”

A little about the possibilities of the vertical. Financial offers have the widest audience. The services of banks, insurance companies or MFOs are always in demand, regardless of the economic or political situation.

If the country has a stable economy and there are no political shocks, the number of mortgages, consumer loans, demand for credit cards and financial services for business are on the increase. A deteriorating economic situation results in microloans, pawnshop services and, paradoxically, Forex trading, becoming popular.

Financial services are needed in both TIER1 and TIER2 countries. All segments of the population actively use them: 20-30 year olds take out microloans, young families, successful business men, military men take out mortgages. People over 30 take out credit card packages and business loans.

Financial affiliate programs have high conversion rates. Even if you don’t need a loan, you will still need a debit or credit card, insurance. But, as always, the issue of choosing an offer is acute. Which product to choose to promote, which payout model to opt for, which GEOs to drive traffic to – more on that later

Features of financial offers

Before you start working with financial affiliate programs, you should mentally prepare yourself for the fact that the price of an error here is noticeably higher than, for example, in gambling or e-commerce verticals. Therefore, you need to start with analysis and planning. The main difficulties you will face:

- stiff competition, sometimes the bid (CPC) from large ad networks skyrockets far beyond $10 and reaches $25 during peak hours (this happens sometimes, it is better to just wait a little and the rates will drop down to the usual $3-8);

- approval – the percentage of confirmed applications, for example, you attracted 30 clients, but only 20% of the applications got approved – you will only get paid for 6. As a result, even if you set up the campaign perfectly, you can still go into the red if you do not take into account the percentage of refusals;

- in the field of finance there are many separate areas: microloans, mortgages, car loans, business loans, insurance, loans for building a house, insurance, credit cards, service packages, etc. If a client is looking for a credit card or a mortgage, naturally, they won’t be interested in car leases or microloans;

- website types. Choosing financial services is not a spontaneous decision. Therefore, we must carefully select the theme of the sites. These should be thematic forums, sites, groups in social networks. If the site is chosen incorrectly, even a large number of clicks will not bring the desired conversion.

Where to drive traffic to

Financial services are always in demand, but there is still a seasonal factor to consider. Business loans become popular in the spring, when new start-ups are launched more often, and farmers also attract additional investment. The demand for consumer loans and microloans grows prior to seasonal sales, national or religious holidays (Black Friday, 11.11, New Year’s/Christmas holidays, Easter, etc.). Credit cards are in demand throughout the year, but there is a slight surge during the summer holiday season (many tourists get insurance or an additional card) or before major sales.

GEO

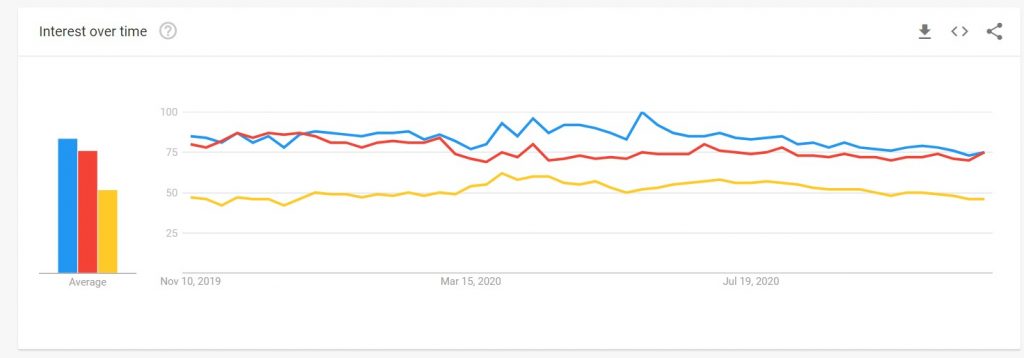

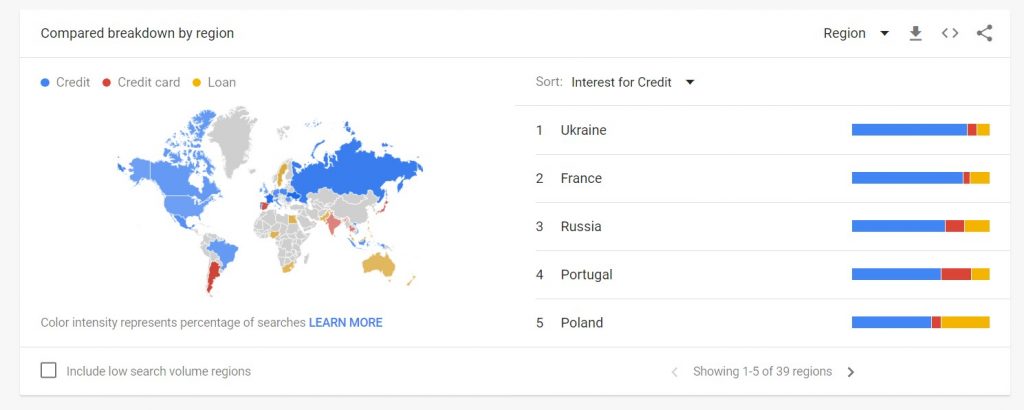

Now let’s move on to another interesting parameter – GEO. Despite the fact that no state can do without financial services, the issuance of credit cards and loans via the Internet is not available in all countries. According to Google Trends, financial services are most often googled in these countries:

- Loans, crediting – most popular in Turkey, USA, Azerbaijan, Ukraine, Great Britain, Uzbekistan, Kazakhstan, Russia, Mexico, Chile;

- Credit cards – there’s high interest in the topic in Argentina, Japan, USA, Chile, Colombia, India, Thailand, Peru;

- Lending – most popular in Kenya, Iran, Nigeria, Ghana, South Africa, USA, Australia, Great Britain.

We can also share the experience of members of the LeadBit partner network who are actively working with Southeast Asia: the Philippines and Vietnam. Online lending is gradually gaining popularity here. The two countries have a population of over 200 million people, who are discovering the benefits of online financial services. There is a stable flow of customers with almost zero competition.

Payout models

When working with financial offers, the most common payment models are Cost per Lead (CPL) and Cost per Action (CPA). Affiliate programs pay for a submitted application or a loan. Some (especially websites for comparing banking products and services) pay per registration.

You’ll rarely find the RevShare model (paying the affiliate marketer a percentage of the profit made off of the attracted client). But that’s not really a problem. In this vertical, RevShare isn’t very profitable: banks charge minimal commissions, and there are not many clients who reapply for a microloan. The CPA model is preferable.

Where to get traffic and how to drive it to financial affiliate programs

Sources

Before reviewing the sources for attracting traffic we should first cover where to look for the target audience. About 70-80% are target customers looking for financial services by directly entering a query in a search engine or on comparison sites for banks, financial instruments, analytical websites.

The second category, 20-30% – users who may become interested in a quick loan when browsing for similar financial services. For example, when they check out thematic sites for reviews of gadgets, household appliances, read articles about tech repair or design. They chat on video games or fishing forums or social media groups. You should be careful when working with such sources, but if you correctly offer a quick loan “for repairs”, phone upgrades or a pair of cute boots, you can get a high ROI.

Main instruments:

- showcase – it can be a one-page landing page or a multi-page website. You don’t have to create it from scratch, there are many ready-made templates on the web. Advantages: includes its own analytics, you can place several offers at once, giving users the illusion of choice. But you need to pay for hosting and maintenance;

- social networks – targeted ads or free posts in groups. Advantages – less than half of banks and MFOs use this promotion channel. But we know that nowadays literally everyone is on social media;

- email newsletter – you can promote one offer or make a showcase letter and simultaneously offer the services of several advertisers. You only need a high-quality customer base, the method works with people between 25 and 40 years;

- contextual ads – considering the size of payments, contextual advertising is a popular choice when promoting financial offers. But if you’re promoting microloans for up to 60 days, then say goodbye to Google Ads – the company has banned advertising of microloans. Alternative tools: Facebook Ads, Yandex.Direct;

- search engine ads (that Google Ads ban on microloan ads is still in effect here). Take into account that many companies have banned search engine ads that mention the brand’s name. Use landing pages, pre-landing pages in the form of showcases, set keywords without specifying the name of the advertiser;

- СЕО – suitable if you have your own website (promotion from scratch will take at least six months). This can be a blog that reviews new household appliances or a financial news website.

Target audience

Choosing the target audience when working with financial affiliate programs is the key to successful arbitration. I already mentioned several times that in this vertical the cost of error is higher. Let me reiterate: if the target audience is determined incorrectly, the conversion rate will not just decrease, it will basically drop to zero. How come? There are several factors at play here.

People don’t just spontaneously decide they need financial services. There are several directions here, if a client is looking for a credit card, they won’t take out a microloan. It is important to consider how wealthy the person is. It makes no sense to offer a platinum card or a loan for a large amount to people with low income or bad credit history – even if such customers are actually interested in something like that, banks will dampen their enthusiasm. By incorrectly choosing the target audience and outlining their needs, we end up with zero CR.

So then, what audience should you focus on? MFOs and banks issue loans to people aged 21-70. But in order to reduce the refusal rate, it is better to cut off some people and set the boundaries from 23-25 to 60-65 years old.

If you are promoting microloans, our main target audience will be as follows: people with secondary or specialized secondary education at the age of 26-35 with a stable source of income (that also need some money until the next payday to solve an urgent problem). Men – 60%, women – 40%. Most often, people who take out microloans earn less than the average salary in the region. They live in small towns.

If you are promoting a mortgage, then there may be several categories: young families who have the right to maternity capital, military men aged 35-45, successful educated men or women with college diplomas and above-average salaries (aged 30 to 40 years).

Creatives

This section should be studied carefully by beginner affiliate marketers. One of the main difficulties of working with financial affiliate programs are creatives. They must be of high quality and inspire confidence. Since money is involved, even the most frivolous people check everything carefully.

Creatives should attract attention, stand out from other banners. The competition here is fierce. Here are some ideas for promoting financial offers:

- classic banners highlighting the advantages: “Loan in 5 minutes”, “Loan without income certificate”, “The first loan without %”, “Free withdrawal of credit funds”, “Your Credit/card has been approved”, etc.;

- showcase – this can be a full-fledged landing page that works the same way product or service comparison portals do – a pop-up banner or widget where you can choose one of 4-6 options;

- giving the user an idea of where to spend their money. For example, if you have your own website with reviews of household appliances, electronics, you can place a banner offering to buy a smartphone or a robot vacuum cleaner and pay in installments. If it’s a thematic women’s website, a culinary forum then use the same idea but swap out the smartphone and Rumba for a multi cooker or a food processor.

A few tips for novice affiliate marketers from members and analysts of the LeadBit partner network:

- It is better to promote financial offers on specialized websites, but you can also try related sites. For example, offer co-branded cards with cashback and discounts on sports goods or online games on sites dedicated to games or healthy lifestyle tips, sports events. An alternative option: advertising loans for household appliances on catalog websites;

- Use your own creatives. Fresh promo materials work better than other people’s hackneyed ones. Even if your competitors “borrow” your creatives, you will always be one step ahead. Just talk to your manager about the creative;

- Calculate the efficiency – take into account the percentage of approval for the offer, the information can be found on the offer page or on third-party websites with an overview of banking products. SubID tags will help you track performance;

Don’t be afraid to go the extra mile – if you launched an ad campaign and it made a profit, do not relax. Today it works, but tomorrow something might change and the conversion rate will drop. Analyze the traffic, optimize the ads to get the most out of every dollar you invest.

TOP 10 financial affiliate programs

MAZILLA

Do not confuse the name with the popular browser. Mazilla is a financial services comparison website. Here you can pick up a loan, microloan or credit card in a few minutes. The Latvian company has performed well so far. It operates in several European countries and has recently launched sites in Vietnam and the Philippines.

The reputation of a reliable service ensures the conversion rate stays high. Although the payouts for a lead here are small ($0.4-0.5), they are more than offset by a consistently high flow of customers. Here you get paid per each confirmed application (registration with the indication of passport data), and not per loan, as is the case with similar offers. Therefore, you won’t be faced with a high rejection rate.

General information:

- website – mazilla.vn;

- payout model – CPL – an application for a loan/credit card confirmed by email, the client must indicate passport and contact information;

- payment size – $0.4 per application;

- GEO – for now the affiliate program only pays for clients from Vietnam, perhaps in the future there will be offers for other countries (the service works in the Philippines, Latvia, Spain, Georgia, India, Indonesia, Malaysia, etc.). There are no prohibited GEOs;

- hold – 5 days;

- cookie lifetime – 30 days;

- allowed traffic sources – white-hat sourced; prohibited traffic sources – toolbar, push-notifications, cashback, branded ads that mention the company’s name, motivated traffic for a minimum requirement, adult traffic, doorwats, ClickUnder, PopUnder.

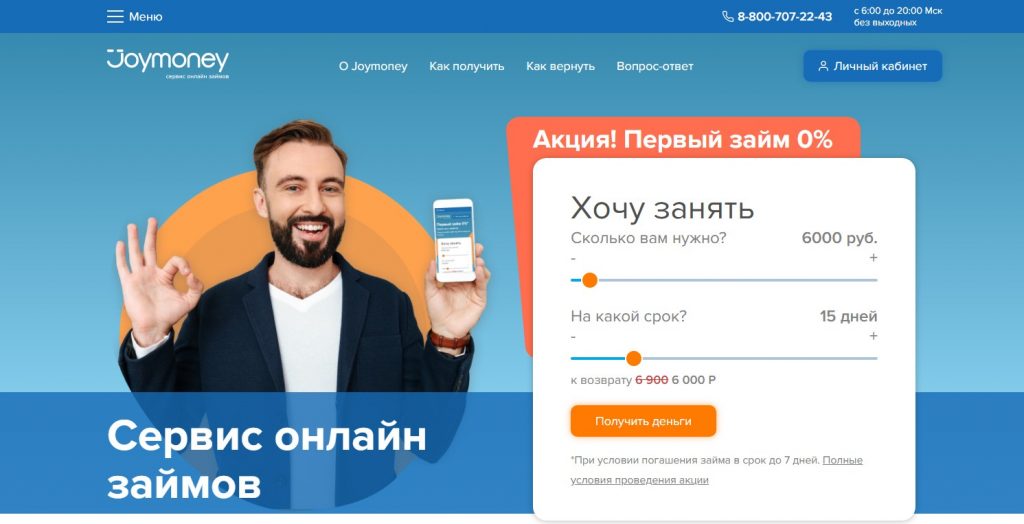

Joy Money

A well-known microfinance organization (MFO) in Russia. It has been operating for several years, having managed to absorb a competitor – “In the Pocket”. The brand is actively promoted, so it won’t be difficult to attract new customers: the company already has a reputation, it’s on everyone’s lips, but so far few potential users decided to take out a loan here.

So far only pays for clients from Russia. The organization plans to enter the markets of neighboring countries. Poland, Kazakhstan, Belarus are under consideration. A huge plus for affiliate marketers is a high payout compared to other financial offers for the Russian Federation.

General information:

- website – joy.money;

- payout model – CPA – per first microloan;

- payment size – $26.6;

- GEO – Russia with the exception of a few regions of the North Caucasus;

- hold – 14 days;

- cookie lifetime – 30 days;

- allowed traffic sources – mobile ads, contextual ads, ad networks, email ads, SEO (but not branded traffic), social media.

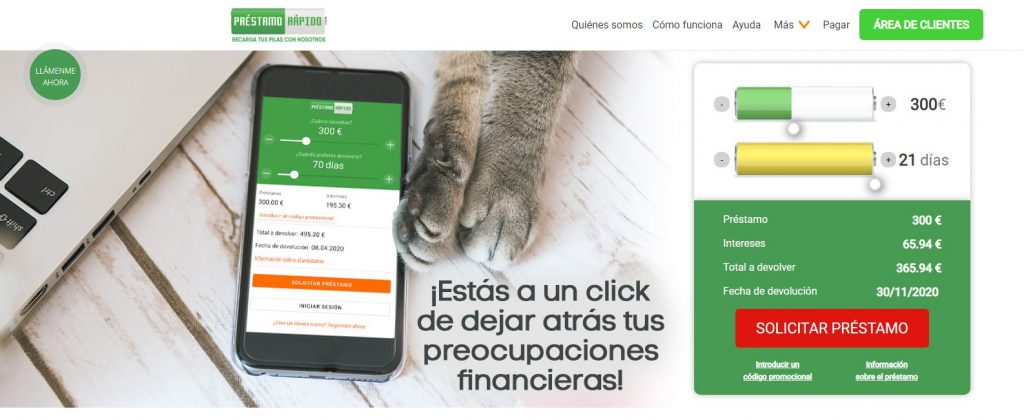

FREEZL

A popular Polish service of quick loans with maturities from 5 to 21 days. The company is well known in Poland and has earned a reputation as a reliable lender with good conditions. Now the service has entered the Spanish market – this is so far only the second country where Freezl operates. They are planning to enter other EU-members’ markets.

Advantages – quick approval of loans, a large enough mini-loan even for new clients.

General information:

- website: prestamorapido.es;

- payout model – CPA – per first loan;

- payment size – $25;

- GEO – so far only pays for clients from Spain;

- hold – 14 days;

- cookie lifetime – 30 days;

- prohibited traffic sources – adult traffic, cashback, motivated traffic for a minimum requirement, branded ads that mention the company’s name, PopUnder, ClickUnder;

- all white-hat traffic sources are allowed – ad networks, teaser networks, social media, contextual ads, banners, push-notifications, email ads, SEO, brokered traffic, mobile ads.

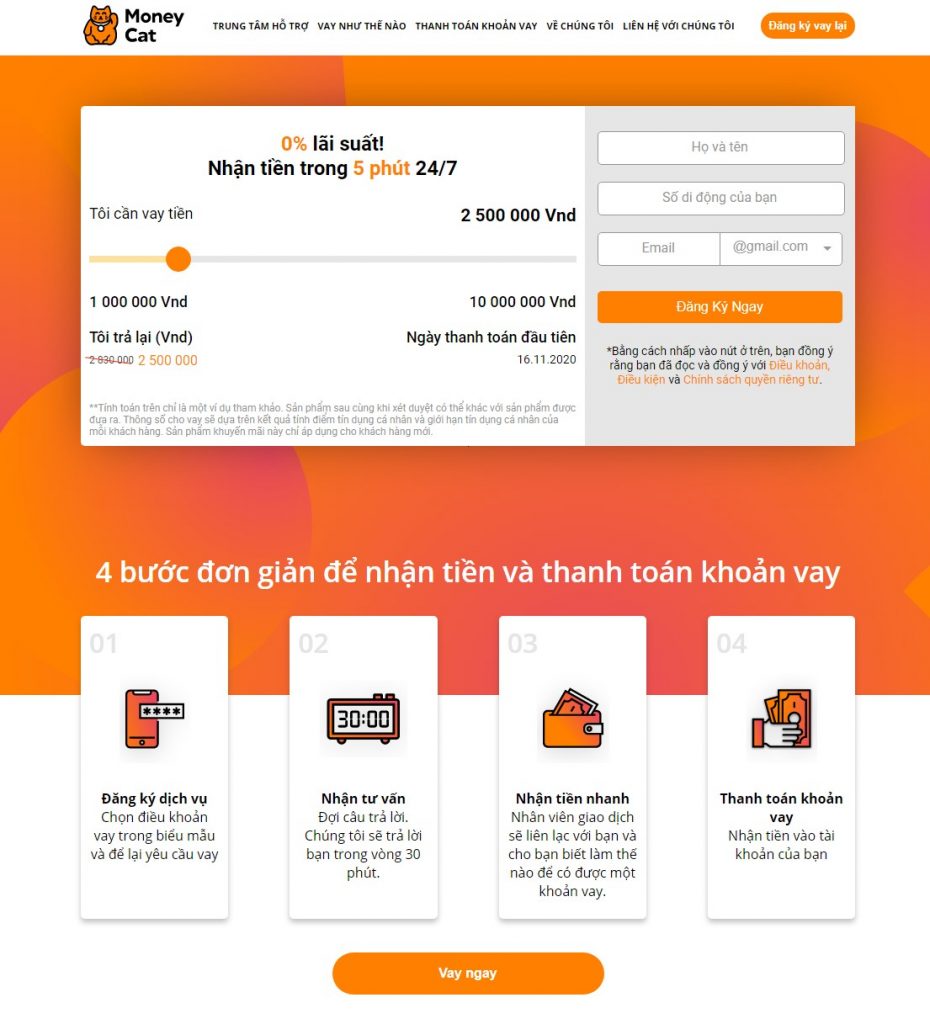

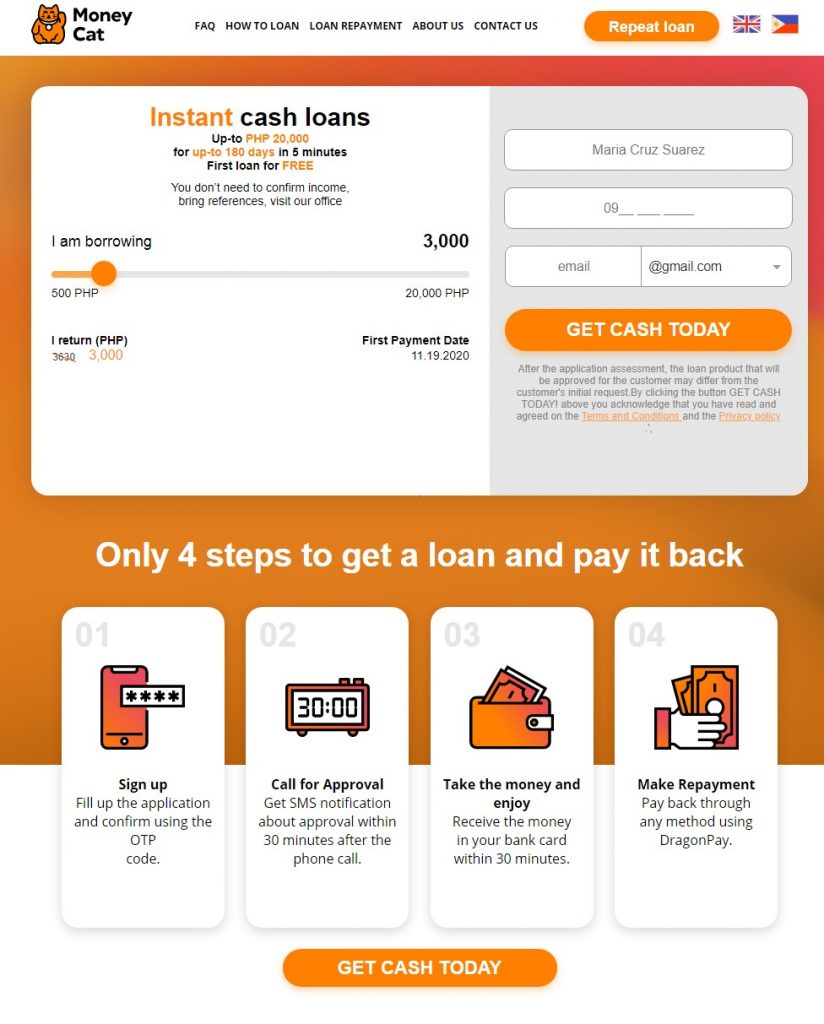

Money Cat

An international microfinance organization that operates in several countries of Southeast Asia (Vietnam, the Philippines), Russia (under the brand name “OneClickMoney”). The service receives good reviews from customers, analysts. Offers a large (relative to the region) loan size at a moderate interest rate.

Currently, the MFO is promoting its services in Vietnam, the Philippines. In these regions, the financial services market is in an active stage of development, with relatively low competition among affiliate marketers.

General information:

- website – moneycat.vn for Vietnam, moneycat.ph for the Philippines;

- payout model and payment size – CPA (per loan, only Vietnam) – $10, CPL (per confirmed application) – $3.6 Vietnam, $5.6 the Philippines;

- GEO – payments only for customers from Vietnam and the Philippines excluding certain Vietnamese regions: Ba Ria-Vung Tau, Long An, Tay Ninh, Thanh Hoa, An Giang, Quang Ninh, Dong Nai, Kien Giang;

- cookie lifetime – 30 days;

- allowed traffic sources – white-hat sources; prohibited traffic sources: PopUnder, ClickUnder, doorways, adult traffic, branded traffic, cashback, toolbar, motivated traffic for a minimum requirement.

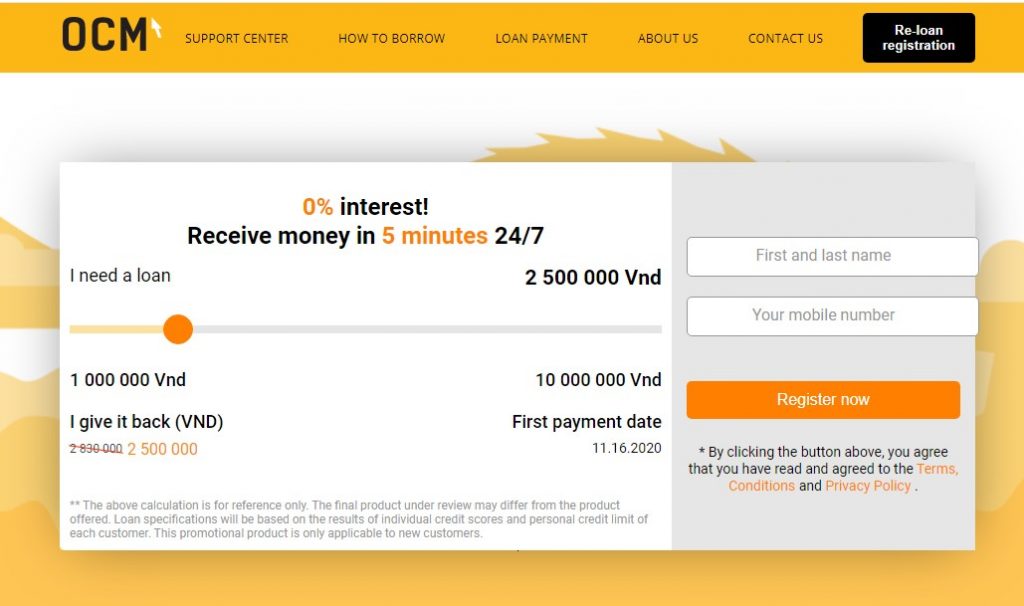

OneClickMoney

A popular Russian service for issuing online microloans has been launched in Vietnam and the Philippines. In fact, this is a clone of MoneyCat with a similar interface and conditions, belongs to the same company, and was created to reach a larger audience.

Unlike other MFOs, this affiliate program pays not only per loan issued, but also per confirmed application.

General information:

- website – OneClickMoney.vn;

- payout model and payment size – CPA – $7.2 per first loan, CPL – $3.6 per confirmed application;

- GEO – оpayments only for customers from Vietnam excluding certain regions: Ba Ria-Vung Tau, Long An, Tay Ninh, Thanh Hoa, An Giang, Quang Ninh, Dong Nai, Kien Giang;

- cookie lifetime – 30 days;

- allowed traffic sources: mobile ads, contextual ads, social media, apps, SEO, Youtube, email ads.

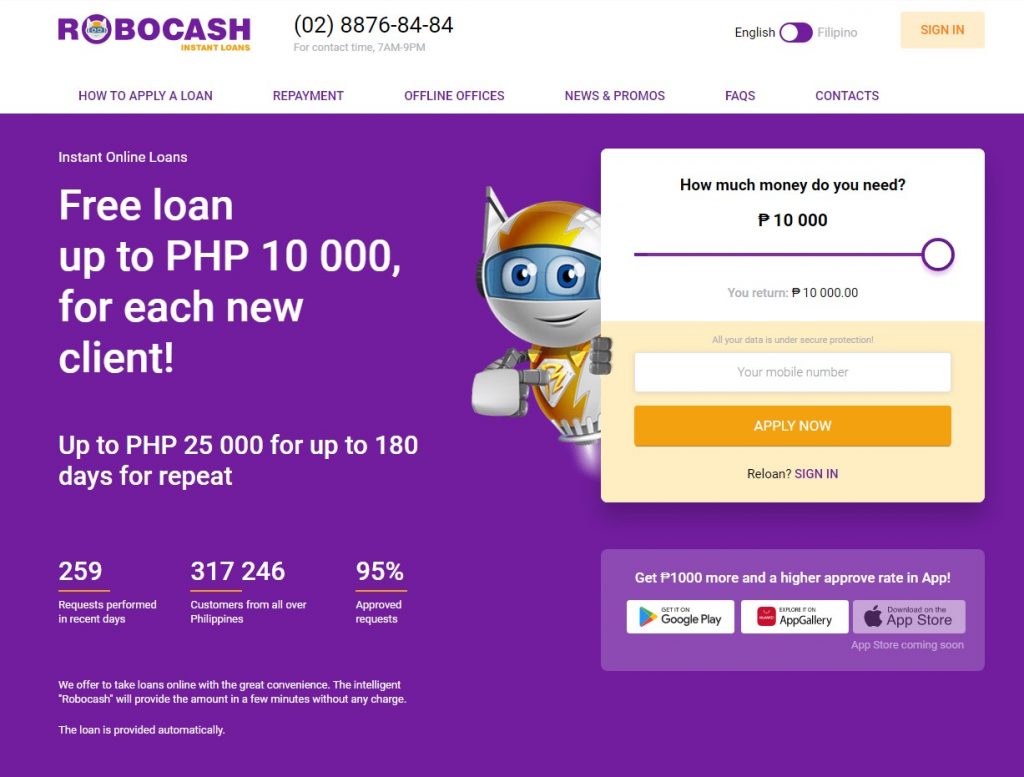

Robocash

A European company that operates in two areas: issuing microloans and as a platform for investing in the microcredit market. Microloans are popular in Southeast Asia and are present in most countries of the region.

A loan service has recently been launched in the Philippines. The company placed an offer with a high pay per lead (confirmed application).

General information:

- website – robocash.ph;

- payout model – CPL (per confirmed application);

- payment size – $4.8;

- GEO – the Philippines;

- hold – 14 days;

- cookie lifetime – 30 days;

- allowed traffic sources: mobile ads, contextual ads, ad networks, teaser networks, social media, mobile ads, apps, SEO, Youtube, banners, brokered traffic.

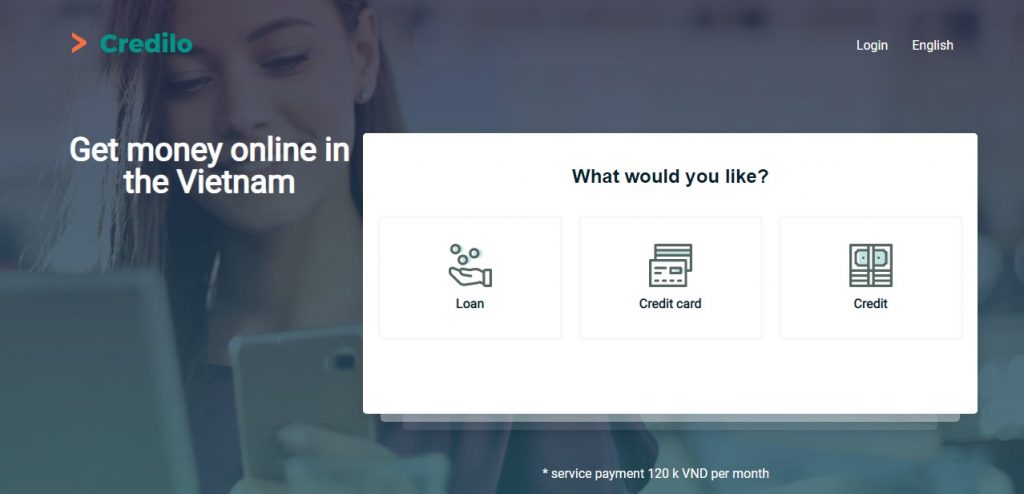

Credilo

An online comparison service for financial services. Operates in Poland, Ukraine, RF, Kazakhstan, Spain, Mexico, Vietnam. The system allows you to pick up a loan, microloan, credit card.

General information:

- websites – credilo.vn;

- payout model and payment size: CPL – $0.6 per new client application;

- GEO – Vietnam;

- hold – 15 days;

- cookie lifetime – 30 days;

- allowed traffic sources – white-hat sources; prohibited traffic sources: doorways, adult traffic, cashback, toolbar, branded traffic, ClickUnder, PopUnder, motivated traffic.

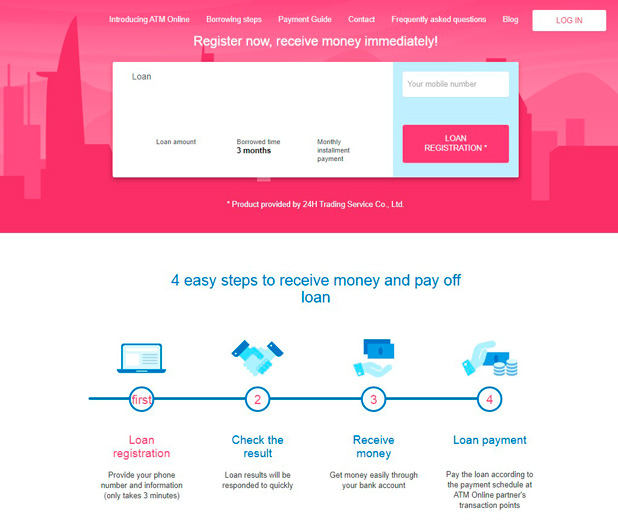

ATM ONLINE

A relatively young microfinance organization that issues microloans in several countries of Southeast Asia: Vietnam and Sri Lanka. Established in 2017. In terms of popularity, it is still inferior to its competitors. It has several advantages: it issues short-term and medium-term loans: from 4 to 6 months at a reduced interest rate (only 12% per year).

General information:

- websites: atmonline.com.vn, atmonline.vn;

- payout model – CPL, $1.6 per confirmed application;

- GEO – new clients from Vietnam;

- cookie lifetime – 30 days;

- allowed traffic sources – white-hat and gray-hat sources; prohibited traffic sources – adult traffic, branded traffic, motivated traffic, teaser networks.

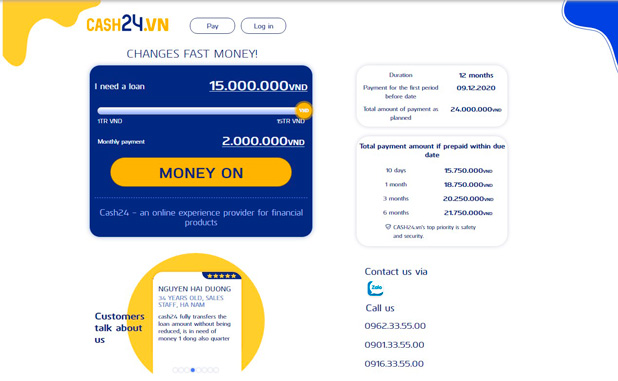

CASH24

A service for issuing short-term and medium-term loans: from 10 days to 6 months. It offers good conditions (0.6% per day for microloans up to a month, the first loan up to 14 days is free). Increases the loan term for regular customers up to 1 year.

General information:

- website: cash24.vn;

- payout model and payment size – CPL – $1.1 per confirmed lead, CPA – $8 per issued loan;

- GEO – Vietnam;

- hold – 14 days;

- cookie lifetime – 30 days;

- prohibited traffic sources – adult traffic, branded traffic, motivated traffic, teaser networks.

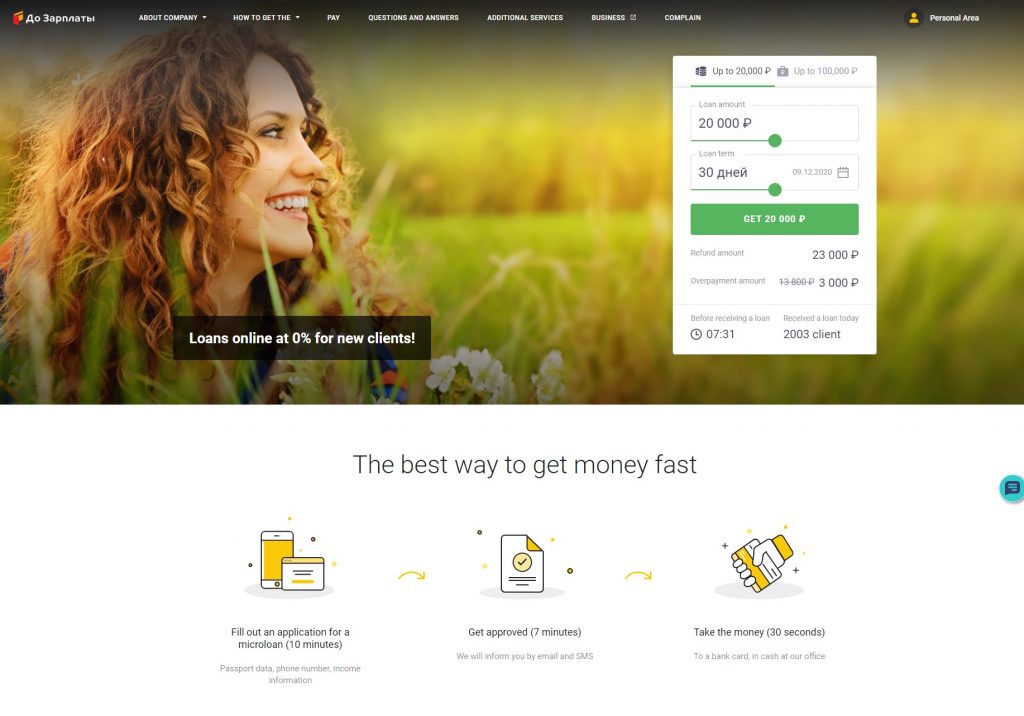

Do zarplaty (Till Payday)

New clients are issued small amounts, around 10-20 thousand rubles for up to 30 days. In the future, medium-term mini-loans up to 12 months are possible.

The service has been operating in Russia for several years, but so far it does not have many clients. Conversion among members of the LeadBit network is over 7%.

General information:

- website – dozarplati.com;

- payout model and payment size – CPA, $16 per issued loan;

- GEO – Russia, clients must have permanent registration in the Russian Federation;

- hold – 30 days;

- cookie lifetime – 30 days;

- allowed traffic sources – mobile ads, contextual ads, ad networks, social media, email ads, SEO.

Cases

Now about the most interesting thing – how to make money? Some practical tips from the members of the Leadbit affiliate network.

$2690 off of financial affiliate programs in Southeast Asia

The Money Cat offer was selected for promotion, the campaign was launched through several targeted advertising networks in Vietnam and the Philippines. A feature of the offer – it pays $10 for approved loans and confirmed applications, (CPL) $3.6 for Vietnam or $5.6 for the Philippines. So we managed to neutralize the influence of approval and slightly simplify the targeting settings, expanding the target audience.

The ad campaign targeted both mobile and desktop devices. Traffic was purchased using the CPA Target and CPC model. After a week-long test, it was decided to keep only the mobile ads. The conversion rate from desktops practically did not grow after launch, it remained less than 0.2%. For mobile devices it ranged from 2 to 5%, during certain hours it jumped to 17%. The cost per click for 3 weeks remained from $ 0.15 to $0.30, once a week before the weekend it rose to $0.6 (this coincided with the increase in conversion, so it ultimately did not affect the overall ROI).

Creatives used. Eight banner variants were developed, the message was the same on each one: you have been approved for a loan in the amount of… We also used pre-landing pages with a small questionnaire (for what purposes the loan is needed, how much is needed, for how long), a timer for 3-4 minutes.

So what did it all add up to? The campaign was launched for three weeks starting September 2. The payment sizes were from $3.6 to $10 (per confirmed application and issued loan). Costs: $10,940, revenue – $13,630.

Profit – $2,690 after 3 weeks. ROI – 24.59%.

Let’s sum up

Financial affiliate programs do not provide ROI of hundreds or thousands of percent. But this vertical is full of potential. There is no seasonality here, and the industry is still growing. Here you can earn tens of thousands of dollars and not worry that the vertical will croak in a year. But it also demands significant investments. This niche is suitable for those affiliate marketers who are ready to earn serious money.